Give

A Legacy That Empowers Riders to Thrive

The impact you make today at Giant Steps doesn’t have to end here. A legacy gift is a powerful way to ensure that future generations of children, adults, and veterans continue to experience the confidence, connection, and possibility that horses make possible.

Through adaptive riding, groundwork, and equine-assisted programs, participants build strength, independence, and belonging in an inclusive community where every success is celebrated. Legacy gifts help sustain financial aid for families, exceptional care for our horses, and the high standards of instruction and safety that define Giant Steps.

As a parent shared:

“Giant Steps has given my daughter Violet so many moments where she can feel accepted and celebrated for all her abilities. The variety of programs and opportunities from horse riding lessons to adaptive horse shows to trail rides to equine therapy have broadened her world and given her confidence, life-changing relationships with horses and the amazing volunteers, and more awareness of her capabilities. Giant Steps has made such a positive impact on her life!”

Video Place Holder

By including Giant Steps in your will, trust, IRA, or other estate plans, you help ensure these opportunities remain accessible for years to come. A legacy gift to Giant Steps is a powerful way to help more stories like this become possible.

Ways to Give

Making a bequest to Giant Steps in your will or trust is easy to arrange and costs nothing to make now. Whether you make a specific bequest or designate a percentage of your estate, your legacy gift will continue to enrich lives through the power of horse, team, and community.

There’s no easier way to sustain the work of Giants Steps than by naming Giant Steps Therapeutic Equestrian Center as a beneficiary of your IRA, qualified pension plan, life insurance, donor advised fund, bank, or brokerage account.

If you are 70 ½ or older, you can give up to $108,000 per year (2025) from your IRA to qualified public charities, like Giant Steps. For IRA owners of RMD age, QCDs can count toward RMD and lower taxable income while supporting riders, horses, and programs at Giant Steps.

Donating certain assets like appreciated stock or real estate can be a tax-wise way to support Giant Steps. Gifts of non-cash assets often provide significant tax benefits while helping to sustain our programs, care for our herd, and expand access for riders of all means.

Charitable Gift Annuities and Charitable Remainder Trusts can provide immediate tax benefits and lifetime income to donors - while helping ultimately helping Giant Steps sustain and grow its equine-assisted programs for future riders.

The Giant Steps Legacy Circle

Ensuring Life-Changing Equine-Assisted Programs - Now and in the Future

“Whatever it is, the way you tell your story online can make all the difference.”

The Giant Steps Legacy Circle recognizes and honors those who have named Giant Steps Therapeutic Equestrian Center as a beneficiary of their will, trust, IRA, retirement plan, life insurance policy, or other estate planning.

Legacy Circle members help:

Provide adaptive riding and unmounted horsemanship programs for children, adults, and veterans

Support scholarships and financial aid so that people of all means can participate

Ensure exceptional care for our horses and safe, high-quality facilities

Sustain our inclusive, affirming community for riders and families

If you have already included Giant Steps in your estate plans - or are considering doing so - please let us know. We would be honored to thank you, welcome you into the Giant Steps Legacy Circle, and acknowledge your generosity according to your wishes.

To learn more about the Legacy Circle and the difference your legacy gift can make, please contact:

Libby Porzig

Executive Director

Giant Steps Therapeutic Equestrian Center

Phone: 707-769-8900

Email: info@giantstepsriding.org

This information is for educational purposes only and is not intended as financial, legal, or tax advice.

Please consult with qualified advisors to determine what types of gifts are best for your personal situation.

A Gift in Your Will or Trust

Whether you designate a specific amount or a percentage of your estate, making a gift to Giant Steps Therapeutic Equestrian Center in your will or revocable living trust is easy to arrange and costs nothing to make now.

You retain full use and control of your assets during your lifetime. Then, through your legacy gift, you can help ensure that riders of all ages and abilities continue to gain strength, confidence, and independence through our equine-assisted programs.

You may choose to:

Leave a specific dollar amount

Designate a percentage of your estate

Gift a specific asset, such as stock or other property

Many donors choose to leave their bequest unrestricted, allowing Giant Steps to allocate funds where they are needed most. Others prefer to support a particular area, such as rider scholarships, equine care, program innovation, or facility needs. We are happy to speak with you and your advisors about options that reflect your intentions.

To make a bequest to Giant Steps, consider adding wording like this to your will or trust:

“I give { ___________ percent of my estate, or description of asset, or ___________ dollars } to Giant Steps Therapeutic Equestrian Center, Inc., 1390 N. McDowell Blvd., Ste. G331, Petaluma, CA 94954, Tax ID: 68-0404917, to support its mission of enriching lives through the power of horses, team, and community.”

Beneficiary Designations

There is no easier way to support the future of Giant Steps than with a gift by beneficiary designation. This type of gift is simple to arrange and can often be completed online or with a single form from your account custodian.

You can name Giant Steps Therapeutic Equestrian Center as a beneficiary of many types of accounts, including:

Life insurance

You may have a life insurance policy you purchased years ago and no longer need for its original purpose. You can name Giant Steps as a full, partial, or contingent beneficiary of the policy or sign over a fully paid policy to Giant Steps and potentially receive an immediate tax deduction for your gift.

IRA, 401(k), and other retirement plan assets

Because retirement assets can be heavily taxed when inherited by individuals, they are often ideal assets to leave to charity. By designating Giant Steps as a beneficiary of your IRA or other qualified retirement plan, you may reduce or eliminate potential income and estate tax on these assets while leaving other, less tax-vulnerable assets to your heirs. You can name “Giant Steps Therapeutic Equestrian Center, Inc.” on your beneficiary designation form to receive a specific percentage of your account value or to serve as a contingent beneficiary.

Bank & brokerage accounts

Bank and brokerage accounts, CDs, and certain other financial assets can also make excellent legacy gifts. You can name Giant Steps as the pay-on-death (POD) or transfer-on-death (TOD) beneficiary, ensuring that the remaining balance benefits our riders and programs.

Donor advised funds (DAFs)

You can name Giant Steps as the beneficiary of all or a portion of your donor advised fund. This allows you to continue recommending grants during your lifetime while ensuring that any remaining balance ultimately supports equine-assisted programs at Giant Steps.

To arrange a gift to Giant Steps by beneficiary designation, consult with your financial institution or plan administrator to request the required documentation and properly record your designation.

IRA Gifts

IRA Qualified Charitable Distributions during life

IRA Qualified Charitable Distributions (QCDs) allow donors age 70½ or older to make gifts of up to $108,000 per individual per year (2025 limit) directly from a traditional, inherited, inactive SEP, or inactive SIMPLE IRA to qualified public charities like Giant Steps Therapeutic Equestrian Center.

Key features of QCDs include:

Gifts are made directly from your IRA to Giant Steps by the IRA trustee or custodian.

QCDs can be excluded from your taxable income, even if you do not itemize.

For IRA owners who are subject to Required Minimum Distributions (RMDs), QCDs can count toward satisfying your annual RMD.

By reducing taxable income, QCDs may help lower your overall tax liability and potentially avoid Medicare surcharges.

Because QCDs pass tax-free to charity, 100% of your gift can be used to support riders, equine care, safety, and program excellence at Giant Steps.

IRA gifts through your estate

Because traditional IRAs are often taxed differently than other assets, they can create a significant tax burden when left to individuals. Naming Giant Steps as a beneficiary of all or a portion of your IRA can:

Reduce or eliminate income tax on the portion left to charity

Preserve other assets—such as cash or real estate—for your loved ones

You can name Giant Steps Therapeutic Equestrian Center on the beneficiary designation form for your IRA and specify the percentage you wish to leave as a legacy gift.

A “Legacy IRA”

A “Legacy IRA” gift can help boost retirement income while providing future support to sustain Giant Steps’ mission. Many IRA owners age 70½ or older can make a one-time, lifetime QCD of up to $50,000 to create a charitable gift annuity (CGA).

By using your IRA to fund a gift annuity:

You receive guaranteed fixed payments for your lifetime.

The distribution from your IRA to create the CGA may be excluded from taxable income.

For IRA owners of RMD age, this qualifying distribution can count toward your RMD.

When the gift annuity ends, the remaining funds will support Giant Steps, helping riders and their families experience the transformative power of horses well into the future.

Please consult with your IRA administrator and qualified advisors to confirm how a QCD and/or IRA legacy gift may work in your situation.

Gifts of Non-Cash Assets

Donating certain non-cash assets, such as appreciated stock, mutual funds, or real estate, can be a smart and impactful way to support Giant Steps. These gifts can provide critical funding to sustain our programs and may offer significant tax advantages.

When you donate long-term appreciated assets (held for more than one year), potential benefits may include:

In many cases, an income-tax deduction for the full fair market value of the asset

No capital gains tax due when the asset is sold by the charity

A gift that is larger than what you might give if you sold the asset and donated the after-tax proceeds

Your gift of non-cash assets can:

Help fund rider scholarships and financial aid

Support the ongoing care and training of our horses

Strengthen program capacity, safety, and accessibility

Because gifts of non-cash assets can be complex, we encourage you to speak with qualified advisors. We are also happy to collaborate with you and your advisors to explore options.

Gifts That Pay Income

Certain planned gifts can provide you - and, if you wish, another beneficiary - with income for life or for a term of years, while ultimately supporting Giant Steps’ mission. These gifts may also offer meaningful tax benefits.

Charitable gift annuities

In exchange for your irrevocable gift of at least $20,000, Giant Steps – in partnership with the National Gift Annuity Foundation - can offer a charitable gift annuity that provides:

Fixed annual payments for life

An immediate income-tax deduction

Avoidance of capital gains tax

The satisfaction of knowing that your gift annuity will sustain the work of Giant Steps

Key features of gift annuities:

Can provide lifetime income to one or two income beneficiaries

Can be funded with cash or appreciated assets like stock

Avoidance of capital gains tax when gift annuities are funded with appreciated assets

Partial, tax-free annuity payments

When the annuity ends, the remainder will be distributed to further the work of Giant Steps for years to come

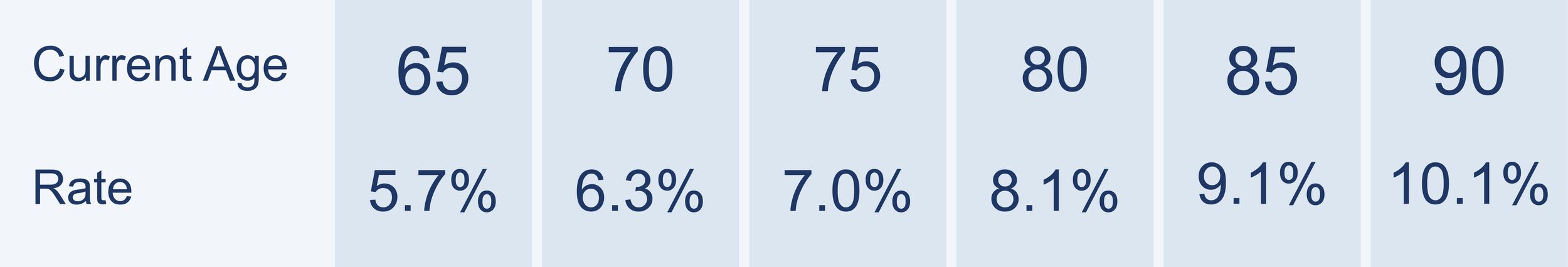

Sample rates for a one-life gift annuity (as of November 2025)

A “Legacy IRA” (QCD-funded CGA)

A “Legacy IRA” gift can help boost retirement income while providing future support to sustain Giant Steps’ mission. Many IRA owners age 70½ or older can make a one-time, lifetime QCD of up to $50,000 to create a charitable gift annuity (CGA).

By using your IRA to fund a gift annuity:

You receive guaranteed fixed payments for your lifetime.

The distribution from your IRA to create the CGA may be excluded from taxable income.

For IRA owners of RMD age, this qualifying distribution can count toward your RMD.

When the gift annuity ends, the remaining funds will support Giant Steps, helping riders and their families experience the transformative power of horses well into the future.

Charitable remainder trusts

Charitable remainder trusts (CRTs) can be a powerful way to convert appreciated assets into income while supporting Giant Steps in the future. When you create a CRT:

You transfer assets (such as appreciated stock or real estate) to the trust.

The trust can sell the assets without incurring immediate capital gains tax.

You (and/or other beneficiaries) receive income for life or a term of years - either a fixed amount (annuity trust) or a percentage of the trust’s value (unitrust).

You receive an immediate charitable income-tax deduction for a portion of the contribution.

The assets placed in the trust may be removed from your taxable estate.

When the trust term ends, the remaining assets are distributed to one or more qualified charities you designate, such as Giant Steps.

Because life income gifts can be complex, we encourage you to speak with qualified advisors. We are also happy to collaborate with you and your advisors to explore options.

Donate A Horse

Our horses are at the heart of all our programs. If you have a horse you would like to donate, please review the following criteria and process for Giant Steps to accept a horse for a trial period.

Contact our Program Director with any questions.

Criteria for Horses Entering the Giant Steps Program on Trial

Age 7 – 18 years old (preferred variety of positive life experience)

Soundness – in all gaits

Temperament – low flight response, trainable, good natured

Size – between 14 -16.2 hh

Training preferred – English, Western, Vaulting, Dressage

Low maintenance – feeding, health care, handling, shoeing,

Good with other horses

Likes people

Able to cope with change

Giant Steps Procedure for Horses Entering the Program on Trial

Horses must meet the criteria listed for new horses and owner must thoroughly complete the New Horse Initial Screening and the first two pages of the Horse Assessment – both are available below to download.. The Program Director will determine if the characteristics of the horse match the current program needs (Giant Steps keeps a diverse herd to accommodate the specific needs of our participant population).

If the horse is within a 50 mile radius of the program site, horses are observed being groomed, tacked, lead and ridden, by the Program Director, Head Instructor and designated program staff. This is either done at the Giant Steps program location or where the horse is currently boarded.

If beyond a 50 mile radius, the owner submits a video of the horse being groomed, tacked, lead and ridden both ways of the ring in all gaits.

If the horse meets the criteria and there is space available, then arrangements will be made for the owner to deliver the horse to Giant Steps for a 60-90 day trial period.

Prior to the delivery of the horse, the owner and the Giant Steps Program Director will sign the “Horse Trial Period Agreement” (for donations) or “Horse Lease Agreement” (for leased equines).

The horse will be in the care and custody of the Giant Steps program staff for the purposes of evaluation and training as outlined in the Horse Trial Agreement. Please note, the owner of the horse is responsible for the cost of board as well as basic veterinary and farrier care while the horse is in his/her trial period.

All horse donations over the value of $5000 need to be submitted with 2 appraisals provided by the donor, prior to the trial period.

The horse will be accepted as a donation to the program once it has completed the trial period successfully as approved by the Program Director. The owner and the Program Director will sign the “Horse Donation Acceptance Agreement”. If the horse is not deemed suitable for the program at any time during the trial agreement the owner of the horse will be notified and is responsible for transportation of the horse off of Giant Steps property.

Please complete and email the following two forms to Julie@giantstepsriding.org.